This represents an adaptation of material that has been carefully researched and organized and provided to our SiteSell members via our private forums. While no vital information has been left out, please note that this information and subsequent discussions were provided to our members first, and that such resources are a benefit our members regularly enjoy.

The following does not represent legal or financial advice. If you have further concerns about your specific business, you should seek professional counsel from your attorney or accountant.

The European Union (EU) has instituted changes to their laws regarding the delivery of electronic goods, and the Value-Added Tax (VAT) that must be applied. These changes go into effect January 1, 2015, and represent a significant hurdle for many small businesses. Our objective here is to take you through this issue, explaining every aspect, and provide thorough recommendations on what steps you can or should take. As new developments and interpretations and options arise, this post will be updated.

The Table Of Contents below outlines the areas we’re going to cover, and can take you to a specific section if you’re looking for specific information. Note that the first three sections outline the problem, while the final five sections outline what you can do about it.

Table Of Contents

- What is VAT?

- Who Is Affected by the VAT Changes?

- What Exactly Is an Electronically Delivered Service?

- Comply with the new rules and handle all the red tape yourself.

- Comply with the new rules using third-party solutions.

- Change the nature of your business so that you no longer sell “electronically delivered services”.

- Keep going as you are but block EU countries from purchasing.

- Ignore everything and carry on regardless.

WHAT IS VAT?

VAT is a tax on the consumption of goods and services (a kind of sales tax, in other words). It exists in much of the world in various forms (ex., GST in Canada), but the changes we’re discussing here apply only to digital sales to customers from the 28 EU Member States…

There are something like 80 different rates of VAT across the 28 states. The “standard” rate varies from 15% (Luxembourg) to 27% (Hungary).

Many goods and services have lower rates of VAT. On e-books, for example, the rate varies from 3% (Luxembourg again) to 25% (Sweden).

And THAT statistic underlies everything we’re discussing here…

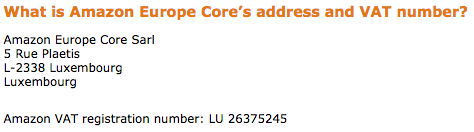

Under the current rules, remember, VAT is calculated according to the location of the supplier. So guess where Amazon has a base in Europe?…

And Apple…

Under the new rules, VAT will be applied according to the customer’s location, which makes it irrelevant where Amazon, Apple, Google et al are located. Yes, all their European sales now get taxed.

One of the consequences of this “EU vs. the Big Boys” battle is that millions of small and medium businesses will get caught in the crossfire. As SiteSell Founder Ken Evoy said about this apparent collateral damage…

This is ugly and desperately short-sighted. The money-grabbing governments claim it was to get the big guys like Google, who re-route income through low-tax havens. Well only believe that if you also believe that these legislators are dumber than amoeba.

Yes, I hear you…

“They must be!”

They must be, indeed. I mean, how hard would it be to have capped businesses at $75,000 of sales to the EU? Less than that and you’re not sucked into this. That would be the RIGHT and SMART thing to do.

It takes 30 seconds to realize THAT. But they’ve been working on this for countless man-hours, both before and after legislation. And, just in case they did not think of it, they have also ignored this suggestion from an enraged small-biz online force for months.

Short-term thinking to maximize a tax grab. It will stifle folks who are just starting out the hardest. A reasonable cap would let folks grow more easily. By the time you reach the cut-off, you’d have the income to pay for someone to handle the bureaucratic crap.

Instead, this will stifle THE VERY PEOPLE who make their own jobs, at a time when the economy is in desperate shape in Europe. Dumb, ugly and stupid.

Exactly.

Here are the current VAT rates throughout Europe:

WHO IS AFFECTED BY THE VAT CHANGES?

First, you need to be selling (or plan to sell) digital goods.

Hard goods aren’t affected by the new rules. (It’s conceivable that they may in the future, but we’ll cross that bridge, if we need to cross it at all, later.)

You are also unaffected if you are not the seller (e.g., you’re merely an affiliate, or you sell through an online marketplace like the Kindle Store… where Amazon is the seller and you are paid a royalty). Indeed, Amazon is one of the “solutions” we’ll explore in a moment.

More exceptions…

If you sell exclusively to other businesses (B2B), this won’t affect you. Comment below with a great big “YAY” if this means you. Congratulations!

Oh, and if you are located OUTSIDE the EU, these changes almost surely won’t apply to you, either (at least not in the “Land of the Real World”). Why not? Because the EU already threw this party for you. And no one came!

Yes, you should have been charging VAT to EU consumers since 2003. I don’t know of any business that knew this or (if they did) that cared about it, so don’t lose any sleep over it.

Still, maybe they mean it “this time” (albeit 11 years late). So you’d better stick around just to keep up-to-speed.

For businesses outside of the EU, given the 11-year history and the total lack of uproar about this from bloggers outside of the EU, my best guess is that history will repeat.

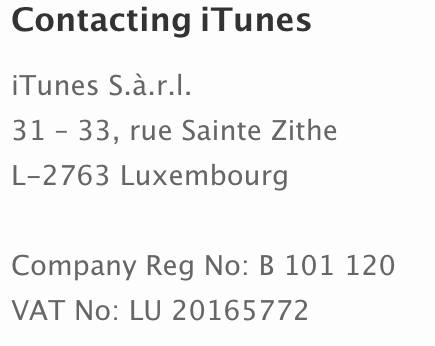

To summarize, here is an at-a-glance guide to the current rules and how they will change on January 1st, 2015:

We have highlighted the ONLY change in red.

Yup, it boils down to this…

EU-Business to EU-Consumer digital commerce is now taxed at the VAT rate in the buyer’s country, not the seller’s.

B2B businesses are not affected and non-EU sellers are probably safe if they ignore this (until further notice). Again, that’s not advice, just an opinion of likelihood based on what we know so far…

We CANNOT advise non-compliance (for obvious reasons). So please keep reading.

For EU businesses, this can get complex quickly.

An EU business is defined as one with a VAT identification number. When they purchase goods related to their business, they should not be charged VAT by their suppliers. But they should declare their purchase (input VAT) and the supplier’s sale (output VAT) in their VAT return (i.e., they cancel each other out).

We only mention it because a service provider who handles VAT would, ideally, handle this end of it, as well. If you supply a business-related product to VAT-registered businesses in the EU, you’ll need to find a sophisticated payment solution which is capable of applying VAT at the correct rate… and then deducting it when a valid VAT id# is supplied.

What Exactly Is an Electronically Delivered Service?

1) The Basics

In plain language, the products that are affected by these changes boil down to the following:

- Anything a paying customer downloads (e-books, images, audio files, and so on).

- Anything they pay to access online (membership site, online course, paid newsletter, cloud services, etc.).

In short, any digital product of any sort is covered.

The only exception to “what’s digital” is for those cases where supplying a particular product to a particular customer requires a significant amount of “human intervention.” In other words…

Your digital product is actually more of a one-on-one service.

That’s fairly simple. But to clear up a confusion we’ve seen elsewhere online, this does not include goods which are merely paid for electronically. They need to be electronic and be delivered electronically.

So if you sell physical books (rather than e-books), CDs (rather than MP3s), or any product that you can “touch,” you’re not affected. They are physically packed and shipped (rather than delivered electronically).

Another potential area of confusion revolves around the European Commission’s use of the term “electronic services.”

An e-book, according to the EC, is a “service.” Indeed, and this is an important clarifier…

Where they mention “goods” at all, they always mean physical goods.

The European Commission defines “Electronically Supplied Services” as follows…

… services which are delivered over the Internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention, and impossible to ensure in the absence of information technology.

That bolding is added for emphasis. If you supply a customer with some sort of custom-/hand-made product, even if that solution is then delivered electronically, it requires more than “minimal human intervention.”

It takes time and effort to create the product. The nature of this much customization means that even delivering it cannot be automated (ex., the way you automate email when someone orders an e-book). You personally email the customer when it’s ready.

An example will clarify.

If you deal with another human being on a one-to-one basis and the digital product you sell to them is custom-made, you’re exempt.

Web designer? Clearly, most of your work is custom. The customer pays you electronically, and the final product is delivered electronically. But apart from that, there’s nothing automated about your dealings with the customer.

However…

If you were to design an unbranded website template and automatically sell/deliver it to anyone who wanted to buy it, that would not be exempt.

What if you designed your generic template but then did customization work for each purchaser (adding their logo and brand colors, say)?

Again, exempt. But if you are thinking about playing “in the gray,” remember this…

The less work you do that is specific to a customer, the more chance you stand of falling foul of tax laws. So be reasonable.

“Minimal human intervention.” Think about that phrase. And then consider if it is possible (or even desirable) to move beyond minimum and alter the very nature of your business.

This is not for everyone, but thinking about this could be the spark that you needed to raise your monetization game.

2) Advanced Information

This is a deeper dive into what precisely is covered by the VAT changes.

The pertinent parts appear below:

The European Commission identifies three categories of service that are affected (if it’s not covered by these three, it’s unaffected):

- telecommunications services

- broadcasting services

- electronic services.

The first two don’t concern us. They cover things like radio shows and satellite TV services. (If you think they do apply to you, see the EC document above for more details.)

“Electronic Services” is the biggie. The EC defines them broadly as…

… services which are delivered over the Internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention, and impossible to ensure in the absence of information technology.

That is then further refined (in “Article 7”) as follows…

(a) the supply of digitised products generally, including software and changes to or upgrades of software; (b) services providing or supporting a business or personal presence on an electronic network such as a website or a webpage; (c) services automatically generated from a computer via the Internet or an electronic network, in response to specific data input by the recipient; (d) the transfer for consideration of the right to put goods or Internet site operating as an online market on which potential bids by an automated procedure and on which the parties are electronic mail automatically generated from a computer; (e) Internet Service Packages (ISP) of information in which the telecommunications component forms an ancillary and subordinate part (i.e. packages going beyond mere Internet access and including other elements such as content pages giving access to news, weather or travel reports; playgrounds; website hosting; access to online debates etc.) Because that’s kind of vague still, the EC clarified further in a couple of Annexes — first Annex II (the numbered points below) and then, confusingly (!), Annex I (the lettered points).Deep breath now…

(1) Website supply, web-hosting, distance maintenance of programmes and equipment

(a) website hosting and webpage hosting;

(b) automated, online and distance maintenance of programmes;

(c) remote systems administration;

(d) online data warehousing where specific data is stored and retrieved electronically;

(e) online supply of on-demand disc space.

(2) Supply of software and updating thereof

(a) accessing or downloading software (including procurement/accountancy programmes and anti-virus software) plus updates;

(b) software to block banner adverts showing, otherwise known as Bannerblockers;

(c) download drivers, such as software that interfaces computers with peripheral equipment (such as printers);

(d) online automated installation of filters on websites;

(e) online automated installation of firewalls.

(3) Supply of images, text and information and making available of databases

(a) accessing or downloading desktop themes;

(b) accessing or downloading photographic or pictorial images or screensavers;

(c) the digitised content of books and other electronic publications;

(d) subscription to online newspapers and journals;

(e) weblogs and website statistics;

(f) online news, traffic information and weather reports;

(g) online information generated automatically by software from specific data input by the customer, such as legal and financial data, (in particular such data as continually updated stock market data, in real time);

(h) the provision of advertising space including banner ads on a website/web page;

(i) use of search engines and Internet directories.

(4) Supply of music, films and games, including games of chance and gambling games, and of political, cultural, artistic, sporting, scientific and entertainment broadcasts and events

(a) accessing or downloading of music on to computers and mobile phones;

(b) accessing or downloading of jingles, excerpts, ringtones, or other sounds;

(c) accessing or downloading of films;

(d) downloading of games on to computers and mobile phones;

(e) accessing automated online games which are dependent on the Internet, or other similar electronic networks, where players are geographically remote from one another.

(f) receiving radio or television programmes distributed via a radio or television network, the Internet or similar electronic network for listening to or viewing programmes at the moment chosen by the user and at the user’s individual request on the basis of a catalogue of programmes selected by the media service provider such as TV or video on demand;

(g) receiving radio or television programmes via the Internet or similar electronic network (IP streaming) unless the programmes are broadcast simultaneously over traditional radio and television networks.

(5) Supply of distance teaching

(a) automated distance teaching dependent on the Internet or similar electronic network to function and the supply of which requires limited or no human intervention, including virtual classrooms, except where the Internet or similar electronic network is used as a tool simply for communication between the

teacher and student;

(b) workbooks completed by pupils online and marked in an automated fashion without human intervention.

If your brain has already gone into overdrive looking for loopholes in the list above, don’t waste your time.

But get this. Everything you’ve just read is from what they call a “work in progress.” So things could change.

WHAT IS THE SOLUTION?

There are actually several available options to businesses… each with their own unique benefits, hassles and caveats.

- Comply with the new rules and handle all the red tape yourself

- Comply with the new rules using third-party solutions (i.e., hand over payment processing/product delivery to a business that handles everything on your behalf).

- Change the nature of your business so that you no longer sell “electronically delivered services” (and therefore won’t be affected by the changes).

- Keep going as you are but block EU countries from purchasing. (Or, if you live in an EU country with a VAT threshold, like the UK, trade with the rest of the world and the UK, but block all other EU countries.)

- Ignore everything and carry on regardless.

We will discuss each option in more detail.

Comply with the new rules and handle all the red tape yourself

Handling the VAT yourself is NOT simple, at least not at first glance. However, if you sign up with a provider who does the heavy-lifting for you, the part that remains (submitting your VAT returns and paying up) is child’s play in comparison.

In other words, despite some of the alarmist material you may have read online, there’s really no reason to be alarmed.

The first thing to do is register for VAT in all 28 EU Member States.

Now, before you run away screaming, even the European Commission understood the impracticality of doing that. So they introduced a system whereby you could register with one EU country (your home country or, if from outside the EU, your EU country of choice) and for that country to forward taxes owed to other countries.

They called this a one-time registration scheme (or mini one-stop shop; MOSS). The scheme has existed for some time for non-EU businesses (the ones who should have been paying VAT since 2003!). In 2015, the scheme will be available to EU businesses, too.

These documents provide detailed notes from the EC itself.

Guide to the VAT Mini One Stop Shop:

Additional guidelines:

No need to read them now. Just remember they’re here if you need to consult them later.

In the UK, HMRC has set up its Mini One-Stop Shop here:

https://www.gov.uk/register-and-use-the-vat-mini-one-stop-shop

That page contains a good overview of the scheme, plus details on how to register for:

- UK businesses (using the “union VAT MOSS scheme”)

- Non-EU businesses (using the “non-union VAT MOSS Scheme”… which replaces the current “VAT on E-Service Scheme” (VoES)).

Non-EU businesses, as we said, can register with any country, though they are more likely to be drawn to English-speaking countries for obvious reasons. Ireland looks set to attract a lot of non-EU businesses to its version of the online portal, as reported here.

Note: EU Countries are allowed to keep a percentage of VAT owed to other EU countries for the next 4 years (30% for 2015/6 and 15% for 2017/8) — hence the motivation for countries to attract foreign businesses to their shores.

If you are an EU-based business, you must register in your own country.

A simple search for “VAT [your country]” will take you to the right place to start drilling.

The ongoing administration of VAT is not so simple because there are so many terms and conditions and requirements.

Using the UK’s VAT MOSS scheme as an example, you and your provider will be required to:

1) Submit VAT returns (and pay VAT owed) quarterly.

2) Collect two pieces of non-conflicting evidence (at the time of purchase) proving the “place of supply” (i.e., which country the customer is from). This can include:

- the billing address of the customer

- the IP address of the device used by the customer

- location of the bank

- the country code of SIM card used by the customer

- other commercially relevant information.

3) If there is a conflict, you will need additional proof. You are allowed to process the transaction but you will be required to contact the customer to obtain the necessary proof thereafter.

4) Keep VAT MOSS records for 10 years.

5) Agree to the auditing of your business by any member state.

There’s a lot of scary stuff online regarding these requirements. One intelligent commentator, for example, posted the following:

A recently retired accountant who worked with PWC in the Bahamas for 23 years told me not to register under any circumstances and described this EU VAT setup as a black hole that will cause never ending stress.

Sound advice or hysterical nonsense?

You decide.

Just don’t lose your sense of perspective. As the owner of a micro-business, how realistic do you think it is that you will be selected for aggressive auditing?

And so long as you handle your tax affairs correctly (not difficult to do with your provider doing the heavy-lifting), you’d have no mistakes to hide anyway.

Comply with the new rules using third-party solutions

(i.e., hand over payment processing/product delivery to a business that handles everything on your behalf).

This may potentially be the most attractive option of all: Getting someone else to DO EVERYTHING:

- shopping cart

- payment processing

- automated delivery of product

- calculation and payment of taxes.

You supply this business with products to sell, and customers to purchase them, at the price you set. The reseller handles all the fiddly stuff around the transaction.

Advantages?

- It’s easy.

Disadvantages?

- It’s a little more expensive, though not much (we’ll cover costs below).

- It may not be as flexible as you would ideally like. For example…

If you are a UK seller, you do not have to pay VAT on sales to your own country (assuming you’re below the VAT threshold). But where a third-party becomes the seller, UK buyers will be charged VAT.

That’s potentially a biggie if you have a lot of UK sales. In that case, your better option may be to block sales to all other EU countries and trade with the UK and the Rest of the World without charging VAT.

Let’s start with the obvious provider:

Amazon

If you sell e-books through the Kindle Store, KDP will handle the VAT for you. If you don’t use the Kindle Store, consider switching — particularly if your e-books have a low price tag (below $10).

The one change you should know about, if you’re an existing publisher, is that the price you set in your dashboard will change from VAT-exclusive to VAT-inclusive.

- Currently, you’d need to set the price at £1.93 so that the customer sees £1.99 (i.e., £1.93 + Luxembourg VAT @ 3%).

- After January 1, you can set it at the VAT-inclusive £1.99.

If the prices are all linked to the U.S. price, however, there’s no need to do anything. (Amazon will convert the USD list price to the local currency and THAT will be the VAT-inclusive price.)

Additionally, note that Amazon will adjust the list price to ensure that it remains within the same royalty plan that was selected before. So if the VAT rises push a book over £9.99 (which takes it from the 70% royalty rate to just 35%), Amazon will adjust the price to make sure you still receive 70%.

The bottom line is that there’s probably nothing for you to do (unless you like to micro-manage all list prices in all currencies).

For more on these changes, see this help page from KDP:

https://kdp.amazon.com/community/ann.jspa?annID=646

Other Marketplaces

Amazon, of course, will only be a VAT solution if you sell a very specific type of product: e-books priced below $10.

If you sell a higher-priced e-book and want to maintain your price point, Amazon won’t be suitable as royalty rates drop to 35% once your price tag is in double digits.

Other online marketplaces offer the same advantage as Amazon (handling VAT for you) but will obviously only be useful for whatever digital products you can sell there: podcasts or apps at iTunes, for example.

Although you can’t sell digital products on eBay, it’s worth a quick mention as fees will be affected by the VAT changes if you are not registered for VAT… and that will have an impact on your margins.

See this page for the details:

http://sellercentre.ebay.co.uk/eu-vat-legislation-changes

Other Providers

That’s the online marketplaces dealt with. The providers below offer solutions for sales of all types of digital products (and hard products, too, in most cases).

As time goes by, more and more all-in-one payment providers are likely to offer solutions to the forthcoming VAT changes. Currently, the following providers are the only ones we have found (other than online marketplaces) who handle VAT for you in a (hopefully) professional and fully-compliant way.

As always, do your research (and ask questions here) before signing up for anything. The following notes will get you started…

FastSpring

FastSpring is so far ahead of its rivals in regard to EU VAT changes, it puts everyone else to shame.

Not only is it fully set up to comply with the changes on January 1, it has actually been charging VAT to EU-based consumers since 2003. (As a US-based company, that is precisely what it should have been doing!)

It is currently registered with the HMRC in the UK and has 10+ years of experience of charging VAT at the correct rates and filing returns.

As it says in its recent blog post, FastSpring has you covered in 3 ways…

- FastSpring already charges VAT based on your customers’ location. This means you won’t have to file any special paperwork or change an existing process.

- FastSpring will continue to file the VAT tax collected for your company.

- FastSpring will keep your VAT documentation for 10 years (required by the new law).

Fast Spring allows you to sell both digital goods and hard goods, and it has all manner of features such as:

- multiple currency support

- support for subscriptions and recurring billing

- branded order pages (hosted by Fast Spring)

- and so on.

Check out the features here:

http://www.fastspring.com/features-overview

You have two pricing options:

- 8.9% per transaction, or

- 5.9% + $0.95 per transaction.

There are no other fees to pay (such as a monthly fee or third-party payment processing costs).

The downside (for UK sellers) is that UK customers will be charged VAT even though, as a UK business below the VAT threshold, you don’t need to charge VAT on sales in your own country.

Why is that? Because FastSpring is the seller, not you. So what you gain in simplicity (no VAT worries), you lose in NOT benefitting from your £81,000 UK VAT threshold.

If you are a UK seller and make many sales within the UK, this is far from ideal.

For all other sellers, FastSpring provides a neat solution.

ClickBank

ClickBank offers full payment processing, product delivery and, yes, tax handling… with the additional benefit of an affiliate network to sell your products (if you wish).

Like FastSpring, ClickBank has been charging VAT to EU customers since 2003. So far, they have been silent on the forthcoming VAT changes. Although, because they are the sellers, it is their problem and not their customers’.

Current pricing is 7.5% + $1.00 per transaction, plus a $49.95 “product activation” fee.

Expensive, yes. But remember that this gives you access to their large network of affiliates (if that interests you).

MyCommerce

On paper, MyCommerce appears to provide everything you need to sell your digital products, including this:

MyCommerce registers, collects and remits all required taxes. We take the compliance burden so you can focus on your business.

Check them out for yourself and see if they fit the bill for you.

Honorable Mentions

The final couple of solutions didn’t make the grade but are at least worth bringing to your attention:

This one failed because it isn’t ready yet (which makes it impossible to evaluate).

However, they are apparently in the process of restructuring their entire business in order to handle the VAT changes (and you’ve got to admire that).

In their own words:

…we have decided to change our business model from Jan 1st 2015 and become a true marketplace where we will sell directly to consumers, handle VAT, download issues, and then pay a sales commission to our sellers.

Their current fee is 5% per transaction plus PayPal fees. But that will obviously change come January 1.

2) Taxamo

Taxamo is NOT a payment solution. There are no shopping carts, no payment processing, no product delivery. They handle VAT by integrating with your existing payment solution (for a fee of €0.20 per transaction).

The caveat is that you need to be a developer to understand the integration.

Change the nature of your business so that you no longer sell “electronically delivered services” (and therefore won’t be affected by the changes).

If affected products form an insignificant part of your turnover (a few e-book sales here and there), consider dropping them. Or sell them instead via the Kindle Store (where Amazon is liable for the VAT and you receive a royalty).

Heck, consider moving operations to Amazon (or whichever marketplace makes sense) even if digital products ARE significant for you…

- The advantages are no VAT hassles (because Amazon is the seller, not you) and a new supply of traffic: Amazon’s own customers.

- The downside is that you will hand over a large chunk of your profits (30% if your book is priced between $2.99 and $9.99; 65% either side of this band).

Another possibility is changing the nature of your e-product so that it takes “significant human intervention” to create and sell that product. In other words, take a generic product sold to all and find a way to customize it to the requirements of individual customers.

Not for everyone, I agree. But it illustrates the sort of creative thinking you could use to exempt yourself from VAT… and take your monetization efforts to the next level.

Selling digital products as hard products (e.g., CDs instead of MP3s, paper books instead of e-books) is another solution. Though what you gain by circumventing VAT rules, you may lose (and more) by taking a giant step backwards.

Sell physical products, by all means, if there is a demand for them from a large enough portion of your audience. But do NOT dent your credibility by offering only an outdated solution when the overwhelming demand is for instant digital delivery.

Your audience comes first, always. It comes before Google. And it sure as heck comes before a bunch of tax-grabbing EU bureaucrats.

And finally, read the Make It! series and sell your own hard goods. Start here…

https://forums.sitesell.com/viewtopic.php?p=1289531#1289531 (Solo Build It! Members Only)

Keep going as you are but block EU countries from purchasing.

(Or, if you live in an EU country with a VAT threshold, like the UK, trade with the rest of the world and the UK, but block all other EU countries.)

If you don’t want to change the nature of what you sell, consider instead getting around the law by changing to whom you sell.

In plain language, that means blocking some or all EU Member States from purchasing your digital products.

If you don’t sell to the EU, you can’t be liable for VAT on EU sales.

What do we mean by “some or all” EU Member States?

– If your business is based in the EU, there is no need to block sales to your own country. Why? Because the law will be effectively unchanged on January 1.

If VAT is currently payable to the supplier’s country, and will change to being payable to the customer’s country in 2015, sales within your country are clearly unaffected. And so long as your turnover within your country does not exceed the VAT threshold for your country (£81,000 in the UK, for example), there is no need to pay or even register for VAT.

As the UK Business Minister himself said,

Micro-businesses that trade only in the UK – and never sell to the EU – won’t have to do anything. They won’t have to register for VAT in 2015.

See this list for thresholds in other EU countries:

http://www.vatlive.com/eu-vat-rules/vat-registration-threshold/

– If your business is based outside the EU, you will need to block sales to ALL EU countries if you opt for this solution.

Whether or not this is a realistic option depends on the current make-up of your sales.

If sales to the EU are minimal, why put yourself through this VAT headache?

The reality, however, is that UK sales are likely to be significant (10%+ of total sales, say). Are you willing to lose that chunk of the market?

Equally, if you keep selling to the UK (and elsewhere), sales will likely be dented by:

i) The addition of VAT onto the ticket price.

ii) More steps to jump through during checkout (e.g., requesting postal address).

So you lose all of the market if you block it. And if you play by the rules, you lose some of the market (due to higher prices and more hassle at checkout).

And that, for non-EU sellers, makes the “ignore this” solution more attractive. (Not that we can advise it.)

For EU sellers, blocking sales to all EU states except your own is worth considering.

How do you block sales to EU countries?

That depends on your payment provider, and whether or not they have a facility to do this.

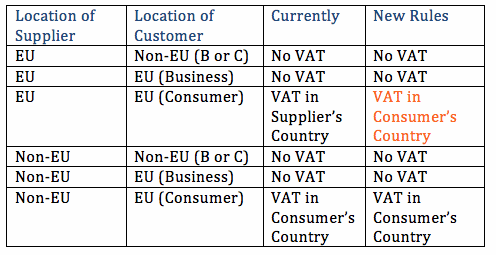

If you use PayPal, it’s simple…

1) On your Account home page, click on the “Fraud Management” link…

2) Scroll to the bottom of the next page and click on “Configure your Fraud Management Filters.”

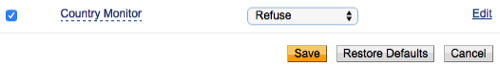

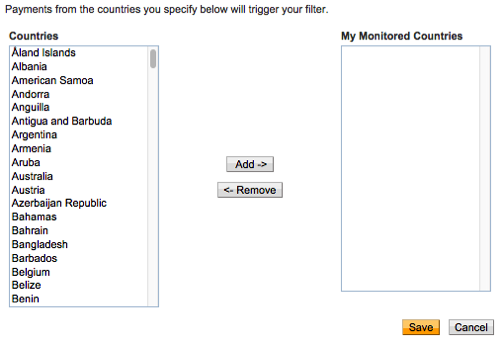

3) Click the “Country monitor” button and select “Refuse” in the dropdown. Then click “edit.”

4) On the next page, add the countries you want to block and click save.

To assist you, here are the current EU countries…

http://europa.eu/about-eu/countries/member-countries/

We covered PayPal above because it is the most popular solution for solopreneurs. If you use a different provider (2checkout, say), ask their support if they offer a similar facility.

That said, there are a couple of excellent providers who do offer this ability to block by country:

- Selz: https://selz.com

- SendOwl: https://www.sendowl.com

Blocking sales not ideal (but then none of these solutions is). However, it is worth considering if:

i) You are a non-EU business and sales to the EU (including the UK) are insignificant.

ii) You are an EU business and sales to the other 27 Member States are insignificant.

Practically speaking, the solution is most likely to appeal to UK sellers (because there is no need to block sales to the “too good to lose” UK market).

Ignore everything and carry on regardless.

First, we should restate our disclaimer from earlier:

Please understand that we CANNOT advise you to ignore/break the law. But we CAN cover the thought processes a person might go through prior to making that decision of their own free will and at their own risk.

What factors should you keep in mind as you consider whether the EU VAT laws can be safely ignored? Ask yourself the following three questions…

Question #1: How Large Is Your Business?

You are not the target of these VAT changes — always remember that.

As we discussed in Part 1, the real aim here is to stop Amazon, Apple (et al) selling digital downloads at Luxembourg VAT rates (3%). Instead, they’ll need to charge the VAT rate in the customer’s country (20%+ in most EU Member States).

Now understand this…

Amazon’s revenue is bigger than yours (just a tad!). And that puts you so far off the radar that the VATman wouldn’t notice you if you stuck a sign on your back saying…

“Tax Me!”

The more revenue you generate, the more visible you become (obviously). But keep things in perspective…

A business with, say, $10M in receipts and a few dozen employees is still likely to be considered a “small” business. So in the larger scheme of things, where does that place you as a likely target?

No offence intended.

The EU probably has no interest in chasing the bit players, anyway. That’s speculative, of course, but it stands to reason.

If you had limited resources to collect unpaid taxes, who would you target: the Big Boys or the little ones?

And in the case of the really little boys and girls (the micro-businesses and solopreneurs), it’s not like the tax authorities would raise much revenue at all (if any).

- VAT receipts would likely be inversely proportional to income tax receipts to a large extent (due to fewer sales or smaller profits, depending on whether the buyer or the seller takes the VAT hit).

- For silly amounts of VAT owed (a €0.99 knitting pattern sold to a little old lady in Boulogne-sur-Mer), the bureaucratic cost of collection would outweigh any amount collected.

- And IF the rules were eventually enforced right down to the micro-level (a massive “if”), many business owners would simply give up or be dissuaded from starting in the first place.

If the EU doesn’t intend to enforce this with any enthusiasm, why would the HMRC (in the UK) have gone to such great lengths over recent days to provide additional guidance on how to comply?

Because they’ve been asked direct questions — what else are they meant to do but answer them?

They can hardly say, “Oh, don’t worry about it, we’re only after the likes of Google.”

The truth is that the UK government (and others?) wrongly assumed that the small players wouldn’t be swept up in this. Why? Because it was assumed that they ALL sell through online marketplaces (like Amazon) where VAT is handled for them.

Just last week, the UK Business Minister wrongly asserted in a widely lampooned statement that…

the majority of UK micro-businesses will not be affected.

The UK tax authorities are not on top of their game, either…

The ONLY UK businesses they have notified of the changes are those already registered for VAT (those with a turnover in excess of £81,000). Unregistered businesses in the UK have received zero communication, despite it being clearly spelled out in their annual tax returns whether or not they sell digital products online.

And get this…

– The UK government is far more up-to-speed on this than most European governments.

– This has been coming down the line since 2008. If the powers that be are in “headless chicken” mode in December 2014, how prepared do you think they are to enforce this at a small-business level?

Question #2: WHERE Is Your Business?

The farther away you are from the epicenter of this so-called earthquake, the safer you are.

If you live outside the EU, you are both far less visible and, even if you did come onto the radar, far less touchable than your EU counterparts.

In other words, good luck forcing Canadians, say, to comply with a European law that the Canadian electorate had no say in.

More than that, good luck enforcing a law that has been in place since 2003… and that the vast majority of non-EU sellers have either ignored or have never heard of.

Short of treaties between all the European countries and all the non-European countries enabling the former to enforce tax collection in the latter, payment of the tax by a non-EU country becomes voluntary de facto.

One of only two references I could find to the European Commission’s understanding of the international implications was this vague statement…

In addition, it should be stressed that this rule is fully consistent with the policy lines currently under discussion at international level.

Under the OECD principles on the taxation of e-commerce, as agreed in 1998 in Ottawa, consumption taxes (such as VAT) should result in taxation at the place where consumption takes place. Those principles underlie the VAT/GST guidelines for B2C services currently being developed by the OECD.

IF such treaties exist, and IF there have been successful legal test cases, don’t you think the European Commission would shout about them… instead of publishing the woolly statement quoted above?

The only other reference came from Patrice Pillet, the EU’s head of VAT legislation. He had this to say on the subject of “engaging and educating” businesses around the world (note the word “voluntary”)…

We will organise events in the United States to talk to American companies, as that is where most of these businesses are located. That is to increase voluntary compliance but, in parallel, we are working on making agreements with other countries to improve administrative co-operation and exchange information.

If you live outside the EU, there doesn’t appear to be any legal weight behind this whatsoever. The EC talks a lot about non-EU suppliers “needing to” or being “required to” register for VAT in the EU.

What if you’re an EU citizen?

Then you’re a lot more visible (at least to the authorities in your own country) and a lot more touchable.

Does that mean that you should comply?

We can’t advise that you don’t. But ultimately it’s your decision to make.

All decisions are about weighing up the facts and the probabilities and making an informed choice.

Question #3: What Are the Implications of Compliance and Non-Compliance?

Legally, you face penalties if you fail to comply. The nature and size of those penalties have not been published.

If that fills you with fear, consider the argument earlier on whether this is even enforceable outside the EU.

And within the EU, consider the size of your business. As Ken said earlier…

I would NOT be panicking about this. They are not in the mood for “Nefarious Mom at Home Fined for Failing to Report $2 of Income from Italy” headlines. Bigger fish to fry, they don’t need to get burned by the press over us.

If the businesses affected by the VAT changes are not ready for them (largely due to not knowing about the changes), 3rd party businesses who could be part of the solution (payment providers, etc.) are not much farther ahead.

Many of them did not know about it at all until customers brought it to their attention a month or two ago.

What about the ethical angle?

Ethically, this tax is WRONG.

How can a legislature impose taxes on people when those people have no mechanism by which to boot out the lawmakers? (And I’m talking about non-EU and EU citizens.)

Furthermore, it is WRONG to impose red tape on businesses who don’t have the resources to handle it. The BigCos will deal with these changes in their sleep. Solopreneurs will have a tougher time (if they try to handle the VAT themselves).

What about the commercial angle?

Let’s not lose sight of what we’re all trying to do here: run profitable businesses.

Charging VAT on EU businesses will impact sales. Or, if you keep your prices where they are and absorb the VAT yourself, it will impact your profits.

Either way, you lose.

eJunkie’s solution to this was to raise your prices to allow for the payment of VAT. If a customer comes from the EU, you’re covered, If not, you can keep the tax. 🙂

For the approach we are proposing, the item prices you define in product settings would be presumed to include VAT, and no VAT would be calculated in the cart before checkout. Only after checkout, when we process the paid order, would we calculate what cut of the gross price(s) paid comprise VAT. This means you could set a gross price (incl. VAT) per product and display that single flat price in your site and advertising.

This also means you would need to raise your item price settings sufficient to cover the highest VAT rate you’d be subject to. Digital goods sold to lower-VAT or no-VAT countries would effectively give you a higher profit margin, as you’d be keeping more of the “VAT overhead” that you’d built into your gross prices.

But what about price testing (which you should be doing to maximize profits)? If you had settled on, say, $39 as your ideal price point, and then you raised it to $47 to cover VAT, your overall revenue drops (and your profits drop by even more).

None of this would be a problem if you were playing on a level field. But the odds are that most of your competitors will NOT charge VAT to EU customers. Until most of them do, think hard before putting yourself at a competitive disadvantage.

If you live outside the EU, you’re in a much safer position than those within. (Ideally, your payment provider will NOT be based in Europe, either.)

The odds are that the vast majority of your compatriots will be unaware of these changes. And even if the EU did have the legal muscle to enforce VAT payment, much bigger businesses than yours would surely be first on the hit list.

If you live within the EU, you are more visible. But your visibility decreases the smaller your business is and the less active your government has been in preparing for this.

If you decide to comply (or alter the nature of your business in some way to exempt yourself), your various options have been outlined above.

Stay up-to-date in the online business world with the free SiteSell Newsletter.

Latest posts by Mike Allton (see all)

- How to Avoid Failure in an Entrepreneurial Business - September 23, 2019

- How to Use Buffer for Social Media Management: The Solopreneur’s Guide - September 15, 2019

- Wix Review: An In-Depth Comparison of 10,000 Websites - September 1, 2019